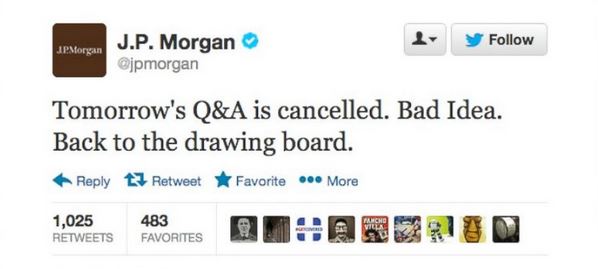

Last week JPMorgan Chase executed what (in hindsight) it admits was a “bad idea.” As you’ve probably heard, the company did what thousands have done before them — scheduled a Twitter Q&A session.

The disastrous results have been documented extensively, and many of the snarky comments and “questions” are good for a laugh. Entertain yourself for hours with that if you want, but this is more than just a flub that yields some humorous results. It’s also a great example of just how difficult it is to fix a broken brand.

OK, so maybe the JPMorgan Chase brand isn’t truly broken. But judging from the events of this week, I’d say that it definitely needs some help. The company has made a strong effort to create goodwill for itself, and it’s got all the slick brand assets you would expect from a multi-billion-dollar financial institution:

- A polished website with prominent home page messages about corporate responsibility and seeing itself “through the eyes of the people we serve.”

- A popular community giving program with more than 3.7 million likes on Facebook.

- Chase Bank even has extensive experience using Twitter to directly communicate with customers.

But it’s clear from the swift negative response to the Twitter Q&A that these successes have not built a beloved brand. So what went wrong?

I think it’s likely that JPMorgan Chase underestimated the damage that’s been done to its brand in the years since the financial meltdown. People take it personally when they lose their home, especially if they perceive that the foreclosing bank hasn’t been playing by the rules. Just a couple of weeks ago, the company announced that it had agreed to a record-setting $13 billion settlement with the U.S. Department of Justice, the capstone of more than three years’ worth of fines and settlements that the company has paid related to the fallout from the 2008 financial collapse. In light of that (and other issues getting play in the press every day), it’s not surprising that some folks were itching to take a shot at them, given the chance.

Big companies have some big advantages, but this incident underscores that they have bigger risks too. Their successes and failures play out on a highly visible stage, which has major implications for their brands. Brand awareness – the Holy Grail for many small businesses — is a breeze for them, but they have a much more difficult time managing the emotional aspects of their brands.

For those of us on the sidelines, there are a few key lessons to learn from JPMorgan’s mistake:

- Branding has many components – awareness, consistency, emotion, uniqueness and adaptability to name just a few. Failure in any one of those areas can have a catastrophic effect.

- Don’t underestimate how long it can take to rebuild a damaged brand. Big mistakes don’t disappear overnight.

- When you’re handling a damaged brand, be open, but not too open. Give your customers ways to communicate, and make sure that you’re listening and responding. But try to have those conversations in places where people who are already invested in your brand will participate.

None of this is easy, but it’s vital. Just #AskJPM.

As design director at Cookerly, Tim serves as the creative lead in the development of branding campaigns, print collateral and digital media for clients across a broad range of industries, including consumer, professional services, healthcare and technology.

As design director at Cookerly, Tim serves as the creative lead in the development of branding campaigns, print collateral and digital media for clients across a broad range of industries, including consumer, professional services, healthcare and technology. As senior vice president at Cookerly, Mike Rieman specializes in building and maintaining relationships with the media and has an excellent track record of landing significant placements in print and broadcast media including USA Today, Wall Street Journal, Bloomberg and Money Magazine.

As senior vice president at Cookerly, Mike Rieman specializes in building and maintaining relationships with the media and has an excellent track record of landing significant placements in print and broadcast media including USA Today, Wall Street Journal, Bloomberg and Money Magazine.

As vice president of Cookerly, Sheryl Sellaway uses her extensive corporate communications background to lead consumer PR efforts, deliver strategy for marketing programs and share expertise about community initiatives.

As vice president of Cookerly, Sheryl Sellaway uses her extensive corporate communications background to lead consumer PR efforts, deliver strategy for marketing programs and share expertise about community initiatives.

As a senior vice president at Cookerly, Matt helps organizations protect and advance their reputations and bottom lines through strategic communications programs. Using creativity, planning and flawless execution, he works with a team to deliver compelling public relations campaigns that produce results and support clients’ business objectives.

As a senior vice president at Cookerly, Matt helps organizations protect and advance their reputations and bottom lines through strategic communications programs. Using creativity, planning and flawless execution, he works with a team to deliver compelling public relations campaigns that produce results and support clients’ business objectives.